Common Itemized Deductions 2025. For the 2025 tax year (and the return you’ll file in 2025), the standard deduction amounts are: Taxpayers who itemize deductions must use schedule a form 1040 to list all of their allowable deductions.

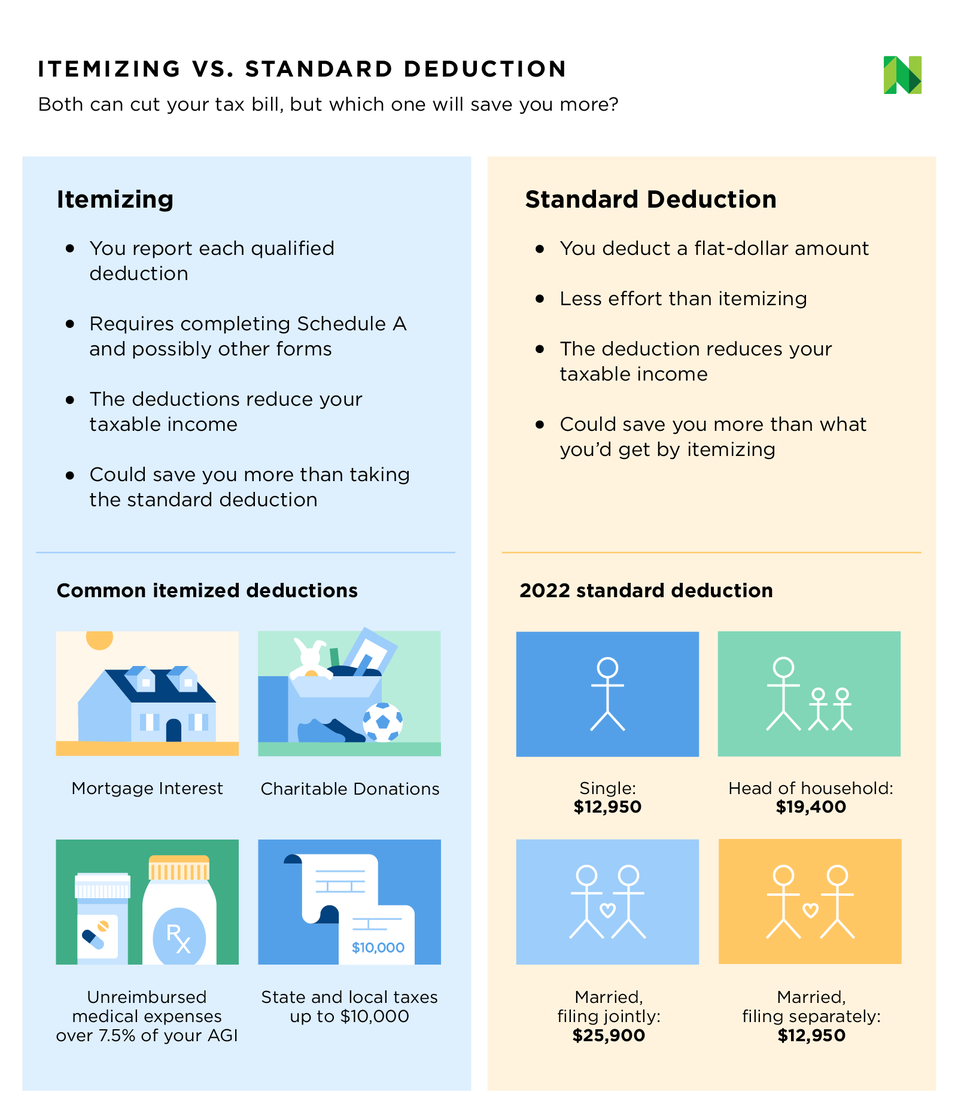

Itemized deductions are an alternative to the standard tax deduction and can help you reduce your total federal income tax bill. Those who are 65 or older and who the irs considers blind get an additional standard deduction.

2025 Itemized Deductions Form Becka Klarika, The standard deduction or itemized deductions. The standard tax deductions have increased steadily since.

Itemized Deductions Definition, Who Should Itemize NerdWallet (2025), Schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). Itemized deductions include a range of expenses that are only deductible when you choose to itemize.

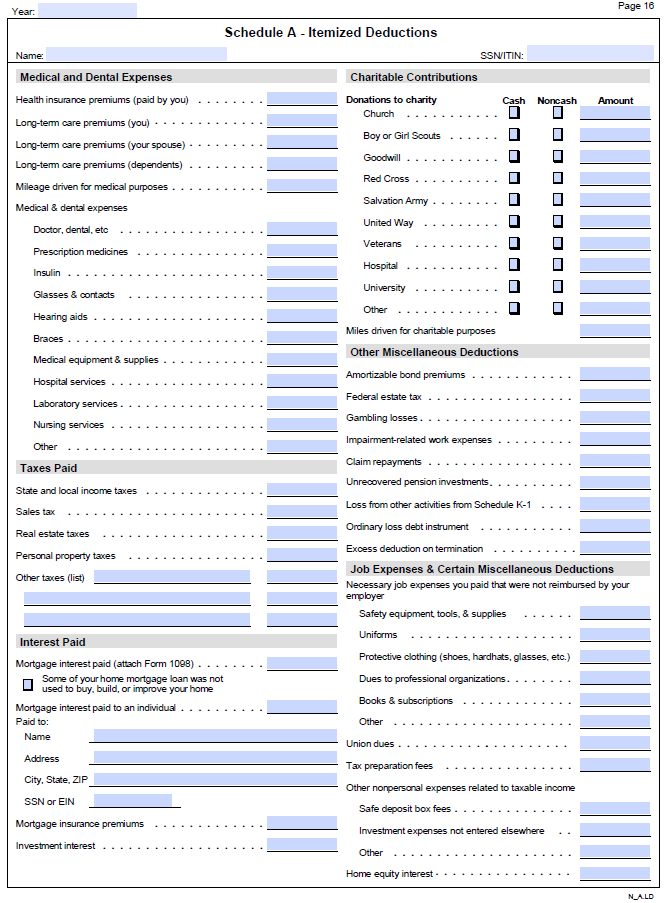

What are itemized deductions and who claims them? (2025), Itemized deductions are recorded on. Each type of deductible expense must be reported in the appropriate section of.

The Most Popular Itemized Deductions, They are computed on the internal revenue service’s schedule a , and. When it comes to reducing your taxable income, you have two options:

5 Popular Itemized Deductions, Each type of deductible expense must be reported in the appropriate section of. The standard deduction or itemized deductions.

How To Reduce Your Tax Bill With Itemized Deductions Bench Accounting, Schedule a is an irs form used to claim itemized deductions on a tax return (form 1040). Each type of deductible expense must be reported in the appropriate section of.

Schedule A Itemized Deductions Daniel Ahart Tax Service®, Tax credits and deductions change the amount of a person's tax bill or refund. See how to fill it out, how to itemize tax.

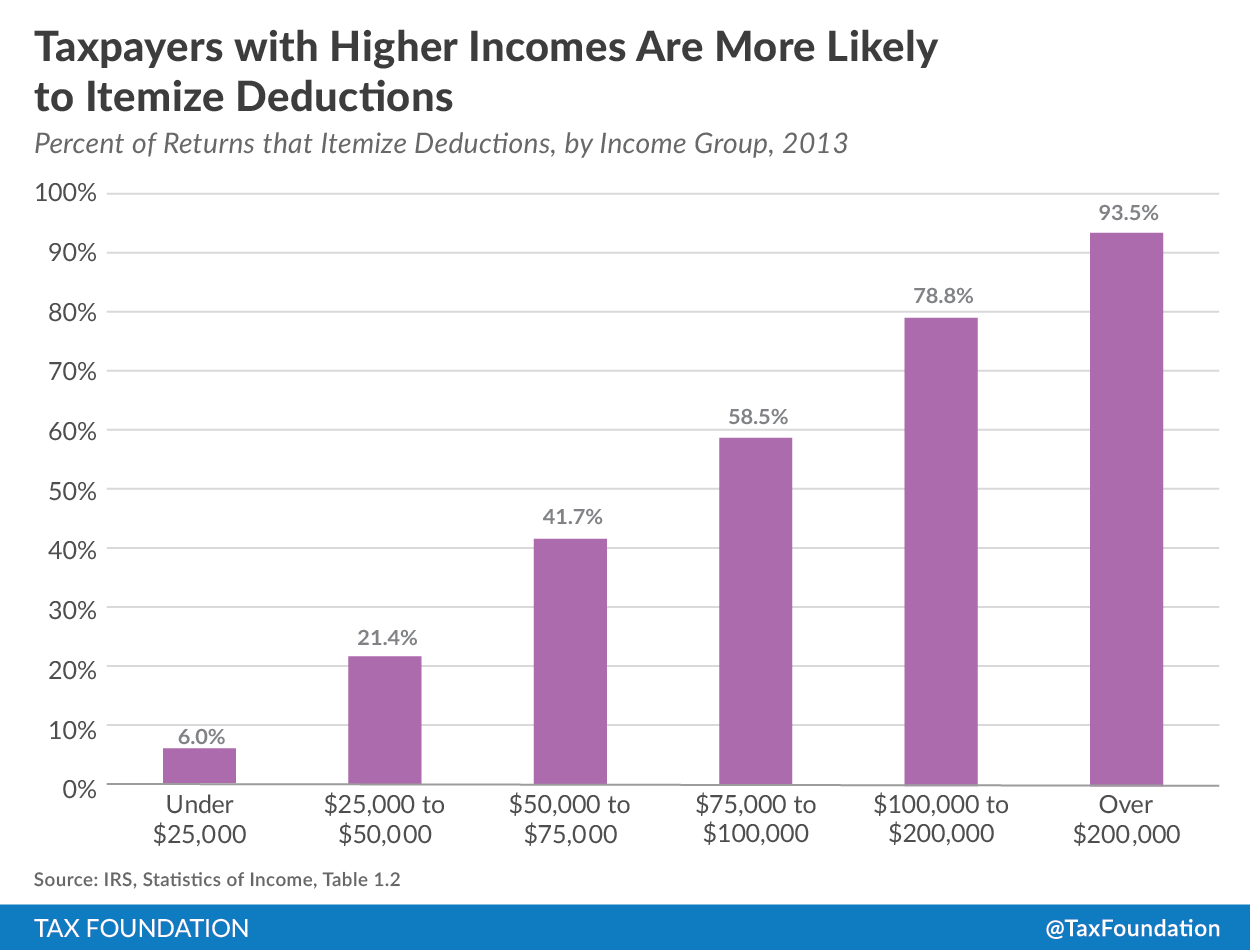

Who Itemizes Deductions? Tax Foundation, The standard deduction or itemized deductions. For comparison, let’s say the standard deduction for your filing status is.

The Most Popular Itemized Deductions Tax Foundation, They are computed on the internal revenue service’s schedule a , and. Itemized deductions include a range of expenses that are only deductible when you choose to itemize.

PPT Itemized Deductions PowerPoint Presentation ID3396847, Tax credits and deductions change the amount of a person's tax bill or refund. 11 tax deductions you can claim without itemizing in 2025.

Subtracting those deductions from gross income yields a taxable income of $65,000, which falls within a 22% marginal tax rate bracket for 2025 and 2025.

For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025;

DIY Tutorials WordPress Theme By WP Elemento